manager-wb.ru Prices

Prices

Amica Vs Usaa

Both Amica and USAA are highly rated for customer satisfaction and service. USAA often has an edge in pricing, especially for military families, while Amica is. Amica received out of 5 stars from WalletHub editors, whereas Safeco received out of 5 stars, and premiums from Amica are generally lower than rates. USAA ranks best nationally for customer service and financial stability, and Amica Mutual performs well in both categories. However, USAA has more affordable. Dividend policies vs. traditional policies. Amica offers two types of policies: dividend and traditional (non-dividend). While both types of policies offer. Good /bad, we are considering Amica insurance company for home and auto. Or tell the USAA rep in these exact words “Please escalate this. Would you choose Amica or Allstate for home insurance? Another insurance company that has as high a rating as USAA is Amica insurance. The General or Amica Mutual Insurance: Which company is best for you? Finally, Amica offers Full Glass Coverage (windows and windshields repaired or replaces at no extra cost), and Rental Coverage of up to $5, towards a similar. Amica received out of 5 stars from WalletHub editors, whereas Nationwide received out of 5 stars, and premiums from Amica are generally lower than rates. Both Amica and USAA are highly rated for customer satisfaction and service. USAA often has an edge in pricing, especially for military families, while Amica is. Amica received out of 5 stars from WalletHub editors, whereas Safeco received out of 5 stars, and premiums from Amica are generally lower than rates. USAA ranks best nationally for customer service and financial stability, and Amica Mutual performs well in both categories. However, USAA has more affordable. Dividend policies vs. traditional policies. Amica offers two types of policies: dividend and traditional (non-dividend). While both types of policies offer. Good /bad, we are considering Amica insurance company for home and auto. Or tell the USAA rep in these exact words “Please escalate this. Would you choose Amica or Allstate for home insurance? Another insurance company that has as high a rating as USAA is Amica insurance. The General or Amica Mutual Insurance: Which company is best for you? Finally, Amica offers Full Glass Coverage (windows and windshields repaired or replaces at no extra cost), and Rental Coverage of up to $5, towards a similar. Amica received out of 5 stars from WalletHub editors, whereas Nationwide received out of 5 stars, and premiums from Amica are generally lower than rates.

The company offers term life and whole life insurance. Whether you are getting married, welcoming a baby or planning for retirement, a life insurance policy. Like USAA, Amica is a member-owned mutual insurance company, which means it is owned by its policyholders rather than by shareholders or private individuals. Amica vs. Progressive: Which Is the Best? (). Amica and USAA are estimates based on Quadrant Information Services' database of auto insurance rates. Both Amica and USAA are highly rated for customer satisfaction and service. USAA often has an edge in pricing, especially for military families, while Amica is. Amica Mutual comes close in terms of price. Haven't had to use them but their claims processing customer service rates as good as or better. Like USAA, Amica is a member-owned mutual insurance company, which means it is owned by its policyholders rather than by shareholders or private individuals. Amica Mutual comes close in terms of price. Haven't had to use them but their claims processing customer service rates as good as or better. Like USAA, Amica is a member-owned mutual insurance company, which means it is owned by its policyholders rather than by shareholders or private individuals. On average, Amica offers cheaper premiums than USAA for drivers with credit scores of less than Insurance shoppers with exceptional credit — a score of. Amica is better than USAA overall, per WalletHub's Grading criteria. Amica beats USAA when it comes to discounts offered, its claims process, and customer. nothing d Cliff Hilton. Amica Please limit posts & comments to things directly or indirectly related to USAA, positive, negative or neutral. Amica vs. State Farm: Which Is the Best? (). State Farm USAA are estimates based on Quadrant Information Services' database of auto insurance rates. USAA, Liberty Mutual, and MetLife. Technology Integration Analyzing AMICA's tech stack and identifying areas for digital transformation or. $50, of bodily injury liability coverage per accident limit. This is the total amount of coverage for costs related to injuries or deaths to other vehicles'. Amica vs. State Farm: Which Is the Best? (). State Farm USAA are estimates based on Quadrant Information Services' database of auto insurance rates. AMICA PROPERTY & CASUALTY INS CO. AMICA WY. LINCOLN. RI. PRIV PASS. SWISS RE CORPORATE SOLUTIONS ELITE. INSURANCE CORPORATION. ELM. USAA ranks best nationally for customer service and financial stability, and Amica Mutual performs well in both categories. However, USAA has more affordable. The General or Amica Mutual Insurance: Which company is best for you? Amica vs. Progressive: Which Is the Best? (). Amica and USAA are estimates based on Quadrant Information Services' database of auto insurance rates. However, USAA still has very high satisfaction ratings since most drivers are very satisfied with how claims are resolved. Drivers can also use the USAA app or.

How To Design Own Website

Weebly's free website builder makes it easy to create a website, blog, or online store. Find customizable templates, domains, and easy-to-use tools for any. Create a professional, free website in minutes · Create a free website that looks great on all devices · Easy to Use · Powerful & Flexible · Customize Your Site. To get started you can find basic code templates or folders online to build off of. Bootstrap is great for creating a basic static site and. For the design part, you can do it yourself by either learning web development or using a website builder tool. Or you can hire a professional . Design and create a professional website with the Wix website builder. Choose from customizable templates and design, then select the features that your. In this blog post, we'll cover what makes a good website, including the essential elements and pages, and provide actionable tips on how to make a good website. Create a customizable website or online store with an all-in-one solution from Squarespace. Choose a website template and start your free trial today. While you can build a simple website for free, you'll need to spend money to design a commercially successful website. It will cost money to get web hosting and. Create your website and grow with confidence. From an intuitive website builder to advanced business solutions & powerful SEO tools—Try Wix for free. Weebly's free website builder makes it easy to create a website, blog, or online store. Find customizable templates, domains, and easy-to-use tools for any. Create a professional, free website in minutes · Create a free website that looks great on all devices · Easy to Use · Powerful & Flexible · Customize Your Site. To get started you can find basic code templates or folders online to build off of. Bootstrap is great for creating a basic static site and. For the design part, you can do it yourself by either learning web development or using a website builder tool. Or you can hire a professional . Design and create a professional website with the Wix website builder. Choose from customizable templates and design, then select the features that your. In this blog post, we'll cover what makes a good website, including the essential elements and pages, and provide actionable tips on how to make a good website. Create a customizable website or online store with an all-in-one solution from Squarespace. Choose a website template and start your free trial today. While you can build a simple website for free, you'll need to spend money to design a commercially successful website. It will cost money to get web hosting and. Create your website and grow with confidence. From an intuitive website builder to advanced business solutions & powerful SEO tools—Try Wix for free.

Appy Pie's website builder is a powerful tool that enables individuals and businesses to create professional websites without any coding knowledge. Create and customize your own business website with an easy drag-and-drop website builder. Get started free. Build and edit your website without any coding. Your professional website in 3 steps · Website creation with AI. Simply log in, describe what kind of website you want to build, and let AI handle the rest. Add a page · On a computer, open a site in new Google Sites. · At the right, click Pages. · At the bottom right, hover over Add New page. · Click New page Add. Learn how to design a website by following our seven simple steps, from setting your website goals to gathering feedback from visitors. Using a Website Builder: Step-by-Step Guide. 1. Decide what kind of website you want to build. With most website builders, you can create just about any type of. The truth about creating a website is that it's no longer the daunting technical feat it once was, especially for newcomers. There's a multitude of tools. This article will dig into how to make a small business website by going over how to get a domain name (that's your web “address”), how to choose a provider to. If you haven't already, it's time to pick a domain name for your website. In this section, I'll walk you through how to sign up for a domain name with Bluehost. Enjoy the freedom of building a professional webpage exactly as you envision it, no design skills needed. Create your own webpage theme by selecting your. Sign up for a website builder plan and start with a pre-built layout. · Add your own images, logos, and text to build your brand. · Add or remove sections to. Create custom, responsive websites with the power of code — visually. Design and build your site with a flexible CMS and top-tier hosting. Google Web Designer gives you the power to create beautiful and compelling videos, images, and HTML5 ads. Use animation and interactive elements. Purchase a domain name; Choose a hosting provider; Pick a website builder; Select a website theme; Plan and produce page content; Add functionality for your. Buying a domain, picking a web host, writing content, designing user flow, and sticking to a cohesive design can take quite a bit of time and strategy but it. Step #1: Selecting the right tool to create a website; Step #2: Planning your website setup and structure; Step #3: Choosing a domain name and web hosting. Easily create, customize, and promote a stunning website that's search engine ready all on your own with the power of Mailchimp's platform. Easy AI-powered site builder. All the features you need to succeed online. Use AI to write website copy & customize your site to be tailored to your business. We'll teach you the basics of web design, and discuss different ways to create your site: from free website builders to professional web design services! First Step - Basic HTML Page. HTML is the standard markup language for creating websites and CSS is the language that describes the style of an HTML document.

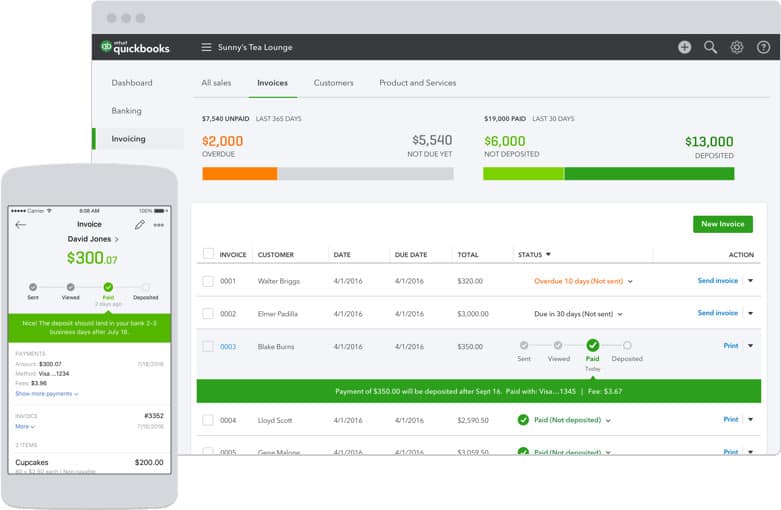

Best Personal Accounting Software For Mac

QuickBooks Online is a comprehensive accounting software for Macs that serves businesses of all sizes. You can handle payrolls, generate business financial. Yes, SlickPie is the best accounting software for MAC. It is a full-fledged accounting software. I am using this software for my business needs. The most intuitive, personal finance app designed for macOS and iOS users. Banktivity gives you the power to finally take complete control of your finances. Top 5 Accounting Software for Mac · 1. Xero · 2. MoneyWorks · 3. GnuCash · 4. FreshBooks · 5. Zoho Books. Money Pro® is the one place for bill planning, budgeting, and keeping track of your accounts. Money Pro works great for home budgeting. YNAB is a personal finance software designed to help you improve your financial literacy as you manage your monthly budget. As you create your budget and manage. Try Quicken Simplifi. For free. · Customers for over 40 years · 94% user approval rating* · Best budgeting app · Best personal finance app. Official Moneyspire® website. The best personal finance software for for Mac and Windows to manage your money and budget. Take control of your finances. GnuCash is designed to be simple to use but powerful and flexible. It allows you to track your bank accounts, stocks and income, as well as expenses. It is as. QuickBooks Online is a comprehensive accounting software for Macs that serves businesses of all sizes. You can handle payrolls, generate business financial. Yes, SlickPie is the best accounting software for MAC. It is a full-fledged accounting software. I am using this software for my business needs. The most intuitive, personal finance app designed for macOS and iOS users. Banktivity gives you the power to finally take complete control of your finances. Top 5 Accounting Software for Mac · 1. Xero · 2. MoneyWorks · 3. GnuCash · 4. FreshBooks · 5. Zoho Books. Money Pro® is the one place for bill planning, budgeting, and keeping track of your accounts. Money Pro works great for home budgeting. YNAB is a personal finance software designed to help you improve your financial literacy as you manage your monthly budget. As you create your budget and manage. Try Quicken Simplifi. For free. · Customers for over 40 years · 94% user approval rating* · Best budgeting app · Best personal finance app. Official Moneyspire® website. The best personal finance software for for Mac and Windows to manage your money and budget. Take control of your finances. GnuCash is designed to be simple to use but powerful and flexible. It allows you to track your bank accounts, stocks and income, as well as expenses. It is as.

Quicken Classic Premier 1-Year Subscription - Mac OS, Windows, Android, Apple · Quicken Classic Deluxe for New Subscribers, 1-Year Subscription - Mac OS, Windows. Results · Quicken Deluxe for New Subscribers, Take control of your personal finances and investments| 1 Year [PC/Mac Online Code] · Quicken Deluxe for New. Banktivity, developed specifically for Apple products, serves as a personal or small business financial management program, allowing users to monitor accounts. MoneyManager Ex is the open source version, available on multiple platforms. HomeBank is the free one, available on multiple platforms as well. MoneyPatrol is undoubtedly the best personal finance software for Mac users. With its seamless Mac integration, robust expense tracking, customizable budget. We recommend three apps above all others: Simplifi, which is best for most people, Quicken Classic if you want to manage your money in more detail, and YNAB. iCash is an easy-to-use, full featured and multi-purpose Personal Finance Software for macOS and MS Windows intended to help you control all kinds of money. Moneydance is best home accounting software for personal and home use. The software gives you an overview of your finances and lets do a number of functions. GnuCash is a personal and small-business finance manager with a check-book like register GUI to enter and track bank accounts, stocks, income and expenses. I have to say that Alzex Personal Finance software is a fantastic product; light-weight, easy to use and gives me the information I need. Quicken Classic Premier 1-Year Subscription - Mac OS, Windows, Android, Apple · Quicken Classic Deluxe for New Subscribers, 1-Year Subscription - Mac OS, Windows. Plan for bills, budget, and keep track of your accounts. Mac. Icon of program. Money Pro is the one place for bill planning, budgeting, and keeping track of your accounts. Easy sync with iPhone/iPad versions. Money Pro works great for home. Money Manager for the Apple Mac is designed for ease-of-use and is suitable for both personal and business applications. If you've never used accounting. GnuCash is personal and small-business financial-accounting software, freely licensed under the GNU GPL and available for GNU/Linux, BSD, Solaris, Mac OS X. Xero · Oracle – Netsuite · Quicken · BankTree · Moneydance; Mint; Honeydue; Mvelopes; PocketGuard; EveryDollar; Money Dashboard; GnuCash; YNAB; Sage Intacct. Mac OS X or Windows, to organize your personal finances is quick and easy MechCAD Software(AceMoney) builds best personal finance software,. AceMoney. Some popular options include YNAB (You Need A Budget), Empower (formerly Personal Capital) and Quicken. These software solutions offer various features such as. GnuCash is designed to be simple to use but powerful and flexible. It allows you to track your bank accounts, stocks and income, as well as expenses. It is as. Moneydance is a powerful yet easy to use personal finance app for Mac, Windows, Linux, iPhone and iPad. With online banking, online bill payment.

Where To Sign Up For A Roth Ira

Open, access and manage a J.P. Morgan Roth IRA via desktop, mobile or meet with a J.P. Morgan Advisor today. After opening up the right IRA for your needs, you. Competitive rates and flexible IRA options: Traditional, Roth, SEP and Coverdell at Truliant are waiting for you to start saving. Learn more today! Open your IRA online quickly & easily. Move money directly from your bank to your new Vanguard IRA® electronically. You'll just need your bank account and. Roth IRA. You can contribute at any age if you (or your spouse if filing You must start taking distributions by April 1 following the year in which. Withdrawals are generally tax-free and penalty free after five years and after age 59½. Income eligibility limitations. Learn more about Roth IRAs. Open a Roth. A Roth IRA will earn you tax-free growth and offer flexibility to use your money without penalties before retirement. The easiest way to open a Schwab IRA account is online. You can also get help opening an account by calling us at or visiting one of local. Interactive Brokers · Firstrade Roth IRA · TD Ameritrade Roth IRA · Charles Schwab Roth IRA · Fidelity Roth IRA · Merrill Edge Roth IRA · TIAA Roth IRA · E*Trade Roth. Find out about Roth IRAs and which tax rules apply to these retirement plans. Open, access and manage a J.P. Morgan Roth IRA via desktop, mobile or meet with a J.P. Morgan Advisor today. After opening up the right IRA for your needs, you. Competitive rates and flexible IRA options: Traditional, Roth, SEP and Coverdell at Truliant are waiting for you to start saving. Learn more today! Open your IRA online quickly & easily. Move money directly from your bank to your new Vanguard IRA® electronically. You'll just need your bank account and. Roth IRA. You can contribute at any age if you (or your spouse if filing You must start taking distributions by April 1 following the year in which. Withdrawals are generally tax-free and penalty free after five years and after age 59½. Income eligibility limitations. Learn more about Roth IRAs. Open a Roth. A Roth IRA will earn you tax-free growth and offer flexibility to use your money without penalties before retirement. The easiest way to open a Schwab IRA account is online. You can also get help opening an account by calling us at or visiting one of local. Interactive Brokers · Firstrade Roth IRA · TD Ameritrade Roth IRA · Charles Schwab Roth IRA · Fidelity Roth IRA · Merrill Edge Roth IRA · TIAA Roth IRA · E*Trade Roth. Find out about Roth IRAs and which tax rules apply to these retirement plans.

Roth IRAs are similar to traditional IRAs, with the biggest distinction being how the two are taxed. Roth IRAs are funded with after-tax dollars. Unlike a. You can open an IRA at financial institutions, such as banks, brokerage firms and even mutual fund companies. While some IRAs have no minimum deposits, others. Want to open an individual retirement account (IRA)? We offer both Traditional and Roth IRAs to help you meet your investment goals. Learn how we can help! Open a Roth IRA at any age as long as you have taxable income. · If your taxable income is less than the contribution limit, you can only contribute up to your. Vanguard, Fidelity, and Schwab are good to go for ROTHs. Just remember to actually select what the roth is composed (index funds for example). You can open an IRA at financial institutions, such as banks, brokerage firms and even mutual fund companies. While some IRAs have no minimum deposits, others. Open a Roth IRA with Merrill and give your contributions the opportunity to grow tax free through retirement. Learn how to get started investing today. Open a Roth IRA · Save for a variety of long-term and retirement goals · Benefit from tax-deductible contributions or tax-free earnings · Have flexibility, such as. No age limit to open or contribute to a Roth IRA. You or your spouse must have earned income to contribute. Contributions may be reduced, or you may be. Savings IRAs from Bank of America and Investment IRAs from Merrill Edge® are available in both Traditional and Roth. Find the IRA that's right for you. Open a Roth IRA · Save for a variety of long-term and retirement goals · Benefit from tax-deductible contributions or tax-free earnings · Have flexibility, such as. If your income is too high for a Roth IRA, you could get to a Roth through the "back door." To use this strategy, you'd start by placing your contribution in a. You can open a Roth IRA via most brokerages, online, or in person. Once you've made an initial deposit, you'll need to choose investments. If you're saving for. Up to $7,; if you're 50 or older, you can contribute an additional $1, in ; Up to $7,; if you're 50 or older, you can contribute an additional. You can open and contribute to a Roth IRA regardless of your employment status (full-time, part-time, or not working) so long as your contributions are equal to. Contributions and earnings in a Roth IRA grow tax-free. Contributions can be withdrawn anytime without taxes or penalties. Withdrawals of earnings are tax-free. Start saving for retirement today. Learn about tax benefits, contributions limits and rules of contributing to a Roth IRA. How to Open a Roth IRA in Five Simple Steps · 1. Make sure you're eligible to open a Roth IRA. The first step in opening a Roth IRA is determining if you're. Bank account details or bank login credentials. Already a Client? Log In to Continue New to T. Rowe Price? Start Now. Back. Need Help? Call

How To Search For Internships

Learn effective strategies, tips, and tools to help you find the perfect opportunity to advance your career. Use Handshake to search for jobs or internships, find inclusive employers, and create job search agents to receive email notifications when new opportunities. 9 ways to find an internship · 1. Determine your career goals and interests · 2. Define your requirements · 3. Start searching early · 4. Reach out to specific. An internship allows college students to take their planned career out for a test drive to find out first-hand what they like and don't like about their chosen. Go directly to job and internship listings. If so, visit Handshake. But if you want more instruction (or you've started searching and it's not working) take. Tell everyone that you're looking for an internship. Opportunities can pop up anywhere. Next, do this: Try UGA's resources. Here are the best websites to find internships: · manager-wb.ru: Your Internship Matchmaker · manager-wb.ru: The Two-Step Internship Finder · Your School's. Find internships near you by searching for "internship" plus any other keywords to describe the internship you're looking for at Job Finder. There are many ways you can find internship opportunities to pursue. Start with Handshake, the University of Minnesota's free job and internship search. Learn effective strategies, tips, and tools to help you find the perfect opportunity to advance your career. Use Handshake to search for jobs or internships, find inclusive employers, and create job search agents to receive email notifications when new opportunities. 9 ways to find an internship · 1. Determine your career goals and interests · 2. Define your requirements · 3. Start searching early · 4. Reach out to specific. An internship allows college students to take their planned career out for a test drive to find out first-hand what they like and don't like about their chosen. Go directly to job and internship listings. If so, visit Handshake. But if you want more instruction (or you've started searching and it's not working) take. Tell everyone that you're looking for an internship. Opportunities can pop up anywhere. Next, do this: Try UGA's resources. Here are the best websites to find internships: · manager-wb.ru: Your Internship Matchmaker · manager-wb.ru: The Two-Step Internship Finder · Your School's. Find internships near you by searching for "internship" plus any other keywords to describe the internship you're looking for at Job Finder. There are many ways you can find internship opportunities to pursue. Start with Handshake, the University of Minnesota's free job and internship search.

Find internships near you by searching for "internship" plus any other keywords to describe the internship you're looking for at Job Finder. This blog is for you. Read on as I share in detail how you can find the right internships (especially paid ones) that you get remote jobs, regardless of your. Glassdoor for Students is where students and recent graduates find internships, entry level jobs, interview questions, company reviews, and salary data. There are many effective ways to find internships. The most successful internship-seekers devote time and energy to search using a variety of strategies. Go through Internships Websites (manager-wb.ru; manager-wb.ru; manager-wb.ru) · Check the "Careers" section of company websites. Internships · Step 1: Learn about internships. · Step 2: Decide to complete an internship for class credit. · Step 3: Find an internship. As the most common way to look for an internship is online, Handshake is UCSB's premium platform for jobs, internships, on-campus interviews, and events. Kickstart your career with an internship that gets you acquainted with your chosen path. Sign up for Tallo now to find your dream internship. Handshake is a free, online job and internship database that has thousands of internships to explore. Employers from all over the country post on Handshake. Start your internship search at the Career Center! Choose from the many resources available in the Experience section of the library and use this list of. You've viewed all jobs for this search. Search similar titles. Internship Developer jobs · Grasshopper jobs · Architecture Intern jobs. More searches. More. Internship Search Engines · manager-wb.ru · manager-wb.ru · manager-wb.ru · manager-wb.ru · manager-wb.ru · manager-wb.ru · manager-wb.ru · manager-wb.ru How to Find an Internship Did You Know? There is not a standard internship hiring structure that every industry follows. It is important for you to. Learn more about finding internships. · Engage in self-assessment · Establish a timeline and specific goals for your search · Learn about career paths and. LinkedIn — A great place to find internships with major companies, LinkedIn is the current king of professional networking websites. Handshake — This career. Find a great college internship. Learn the ins and outs of getting the best internships. Search thousands of internship listings. This site focuses on the up-and-coming workforce and is a great place to look for internships. There are thousands of entry-level jobs, part/full time, and. An effective job or internship search often requires interacting with employer and organizations in multiple ways. Kickstart your career with an internship that gets you acquainted with your chosen path. Sign up for Tallo now to find your dream internship. When searching for the right internships, students must consider both their degree and accompanying career options. Just as one degree may lead to several.

How Many Rental Mortgages Can I Have

You can actually take up to as many as 10 loans at once with FNMA's Properties Program. Here's the criteria you must meet to qualify. In Canada, you can have multiple mortgages on different properties simultaneously. There is no specific legal limit on the number of mortgages you can have. In many cases, investors can get up to four mortgages through traditional means. But other programs and loans can help borrowers to buy 10 or more properties. Rule #1 – You can have as many mortgages as you want! This comes as a surprise to most, but there's no law stopping you from having multiple mortgages. While there's technically no "limit" to the amount of investment real estate you can own, there are several important things you'll want to consider. In most cases, lenders will only allow borrowers to have one or two mortgages at any time. It means that if an investor already has a mortgage on one property. How many mortgages can you have? Whether it's 2, 3, or more, you can reach your rental property goals. The maximum is 10 or even That individual bank may not issue you more than manager-wb.ru Fannie Mae's guidelines are I use a mortgage broker, so almost all my loans are from different. You can have up to 10 mortgages, according to the Federal National Mortgage Association (a.k.a. Fannie Mae). Multiple properties can help you increase your. You can actually take up to as many as 10 loans at once with FNMA's Properties Program. Here's the criteria you must meet to qualify. In Canada, you can have multiple mortgages on different properties simultaneously. There is no specific legal limit on the number of mortgages you can have. In many cases, investors can get up to four mortgages through traditional means. But other programs and loans can help borrowers to buy 10 or more properties. Rule #1 – You can have as many mortgages as you want! This comes as a surprise to most, but there's no law stopping you from having multiple mortgages. While there's technically no "limit" to the amount of investment real estate you can own, there are several important things you'll want to consider. In most cases, lenders will only allow borrowers to have one or two mortgages at any time. It means that if an investor already has a mortgage on one property. How many mortgages can you have? Whether it's 2, 3, or more, you can reach your rental property goals. The maximum is 10 or even That individual bank may not issue you more than manager-wb.ru Fannie Mae's guidelines are I use a mortgage broker, so almost all my loans are from different. You can have up to 10 mortgages, according to the Federal National Mortgage Association (a.k.a. Fannie Mae). Multiple properties can help you increase your.

Many don't. There's an official limit of With many banks, though, the actual limit is 4. See this and this and this. To qualify for a mortgage for rental property, your DTI should ideally fall between 36% and 45%. In many cases, borrowers can count 75% of their potential. If your home is an investment property, however, lenders will generally allow you to count up to 75% of your expected rental income toward your DTI. This can. And from applying for a loan to managing your mortgage, Chase MyHome has everything you need. Buying a House. Whether you're determining how much house you can. The number of mortgages you can have depends on a few factors, ranging from your individual circumstances to general lending rules and industry standards. If you're shopping around for a rental property loan online, you can get a free rate quote from an experienced mortgage professional on Stessa. Here are. When applying for an FHA or conventional loan, you can count 75% of your rental income from a property you already own or the rent you expect to receive from a. That individual bank may not issue you more than manager-wb.ru Fannie Mae's guidelines are I use a mortgage broker, so almost all my loans are from different. Do you currently work with active investors? How many loans can YOU offer any one investment property mortgage lender? Do you personally own rental property? Fannie Mae (FNMA) does limit the number of properties that can be owned or financed when applying for new loan to purchase or refinance a non-primary residence. How many mortgages can you have at a time?(multi-family homes used as rental properties) There is no limit. 10 Freddie and Fannie loans. Once. Investors with a good credit rating can generally finance up to four rental properties using conventional financing from a traditional bank or credit union that. If you are buying residential property of 1–4 units and are seeking a conventional loan that will ultimately sell to Fannie Mae or Freddie. Conventional loans also have limits on the amount of money you can borrow. The conforming loan limit for one-unit properties is $, in most of the. Just because you can qualify for up to 10 mortgages, doesn't mean you're automatically cleared to take on this many notes. The mortgage qualification process is. You may, though, be able to take out two residential mortgages if, say, you live in one property during the week for work and in another during the weekends. You can own as many properties as you can afford. However, you're capped at 10 properties through conventional mortgage lending. How does the IRS define an. When applying for an FHA or conventional loan, you can count 75% of your rental income from a property you already own or the rent you expect to receive from a. Additional reserve requirements apply to second home and investment properties based on the number of financed properties the borrower will have. The. The Federal National Mortgage Association (FNMA), otherwise known as Fannie Mae, allows buyers to have up to 10 conventionally financed properties. That is.

Short Term Marketing Strategy

Short-term strategies focus on immediate gain, for example, a sales spike. This is often called 'sales activation'. In contrast, long-term strategies measure. To ensure marketing is successful for an organization, companies need to compose long-term marketing strategies promoting their goals with specific actions. A. Short-term strategies focus on immediate results through promotional campaigns and social media advertising. In contrast, long-term strategies aim for. This blog post will provide you with valuable insights on effectively marketing your vacation rentals using various platforms, strategies, and techniques. The Long and the Short of it: Balancing Short and Long-Term Marketing Strategies [Les Binet, Peter Field] on manager-wb.ru *FREE* shipping on qualifying. Lastly, pulling back on long-term marketing increases your cost of acquisition. So the reality of a short-term marketing strategy is share contraction. Content marketing: a long-term strategy · Brainstorm content ideas based on target keywords · Look for related keywords · Create content based on target. Long-term campaigns were three times more efficient than short-term campaigns, three times more likely to drive market-share improvement, and 60 per cent more. Short-term marketing plans help the business reach long-term goals outlined in annual business plans. Short-term strategies focus on immediate gain, for example, a sales spike. This is often called 'sales activation'. In contrast, long-term strategies measure. To ensure marketing is successful for an organization, companies need to compose long-term marketing strategies promoting their goals with specific actions. A. Short-term strategies focus on immediate results through promotional campaigns and social media advertising. In contrast, long-term strategies aim for. This blog post will provide you with valuable insights on effectively marketing your vacation rentals using various platforms, strategies, and techniques. The Long and the Short of it: Balancing Short and Long-Term Marketing Strategies [Les Binet, Peter Field] on manager-wb.ru *FREE* shipping on qualifying. Lastly, pulling back on long-term marketing increases your cost of acquisition. So the reality of a short-term marketing strategy is share contraction. Content marketing: a long-term strategy · Brainstorm content ideas based on target keywords · Look for related keywords · Create content based on target. Long-term campaigns were three times more efficient than short-term campaigns, three times more likely to drive market-share improvement, and 60 per cent more. Short-term marketing plans help the business reach long-term goals outlined in annual business plans.

Instead of giving up on campaigns, you should be redefining your timelines and short-term expectations, allowing for testing, and having patience. A marketing strategy is a long-term plan for achieving a company's goals by understanding the needs of customers, whilst creating a distinct and sustainable. Lead Generation · Brand Building · Marketing Strategy; Communication Strategy; Public Relations; Website Development; Corporate Videos; Advertising Campaigns. Sales Promotions Beyond the Short-Term: Aligning Your Strategy with Long-Term Marketing Goals · Sales Promotions and the Customer Journey · The Art of Choosing. A long-term marketing strategy is a process of developing and implementing a plan that will last at least 3 years. This is also known as an extended period. The. Why should businesses invest in a long-term marketing strategy if they're already seeing results from short-term campaigns? Many companies, notably smaller. It showed that firms with long-term strategies had 47 per cent more top-line growth than the other companies; 36 per cent higher earnings; and added average. Why should businesses invest in a long-term marketing strategy if they're already seeing results from short-term campaigns? Many companies, notably smaller. Differences Between a Short- & Long-Term Period of a Marketing Plan. Marketing managers divide promotional activities into short- and long-term periods that. An effective marketing strategy requires a balance between short-term and long-term goals. Short-term goals aim for immediate results. Read on to learn about the different long term and short term digital marketing strategies, and which, if any, are the frontrunners for getting results. Studies show that long-term strategies are more effective at supporting profitability, revenue and market share goals. Short term campaigns to attract or win back customers, will only last until your competitors offer the same or similar offering or until the campaign is over. Short-term digital marketing strategies are quick winners, and long-term digital marketing strategies are for a big and long-term league. A decent short-term rental marketing strategy can boost your revenue from earning a passive income to reeling in the profits. Instead of eating a large marketing cost with a short-term strategy, companies can use a long-term approach to be able to gauge campaign. Eagerly anticipated update of Marketing in the Era of Accountability, examining the impact of timescales of effect, exploring the tension between long and. A decent short-term rental marketing strategy can boost your revenue from earning a passive income to reeling in the profits. Do we want to stay with smaller, upscale retailers or seek market expansion through large discount chains? Will our proposed new product take sales away from.

How To Set Up A Sep Ira Vanguard

Compare the small business retirement plans we offer: i(k), SEP-IRA, SIMPLE IRA, and Small Plan (k). How to fill out the Vanguard Brokerage IRA Distribution Form · Section 1: Enter your IRA brokerage account number and enter the last 4 digits of your SSN. Decide which IRA suits you best. Start simple, with your age and income. Then compare the IRA rules and tax benefits. Compare Roth vs. traditional IRAs >. Vanguard will not be able to establish or amend your plan as necessary. It appears that you can't set up automatic exchanges within your account. All you have to do is go to any financial services provider, and they can open one up for you with virtually no paperwork, in about 2 minutes. Account setup: You can download the Individual (k) Employer Kit from Vanguard's website. It includes instructions and all the forms you need to set up your. To establish a SEP–IRA for your employees, choose from 2 account types: • Vanguard SEP–IRA. Select from more than 70 no-load Vanguard mutual funds suitable for. Open your IRA today For more information about Vanguard funds or ETFs, visit manager-wb.ru to obtain a prospectus or, if available, a summary prospectus. The Ascensus SEP IRA featuring Vanguard investments is a simple and flexible tax-deferred retirement plan for small business owners. Compare the small business retirement plans we offer: i(k), SEP-IRA, SIMPLE IRA, and Small Plan (k). How to fill out the Vanguard Brokerage IRA Distribution Form · Section 1: Enter your IRA brokerage account number and enter the last 4 digits of your SSN. Decide which IRA suits you best. Start simple, with your age and income. Then compare the IRA rules and tax benefits. Compare Roth vs. traditional IRAs >. Vanguard will not be able to establish or amend your plan as necessary. It appears that you can't set up automatic exchanges within your account. All you have to do is go to any financial services provider, and they can open one up for you with virtually no paperwork, in about 2 minutes. Account setup: You can download the Individual (k) Employer Kit from Vanguard's website. It includes instructions and all the forms you need to set up your. To establish a SEP–IRA for your employees, choose from 2 account types: • Vanguard SEP–IRA. Select from more than 70 no-load Vanguard mutual funds suitable for. Open your IRA today For more information about Vanguard funds or ETFs, visit manager-wb.ru to obtain a prospectus or, if available, a summary prospectus. The Ascensus SEP IRA featuring Vanguard investments is a simple and flexible tax-deferred retirement plan for small business owners.

Welcome to the account login page for Vanguard Retirement Plan Access. You Set Up Your Online Account. Get Started. All investing is subject to risk. and benefits that come with the different plan types administered by Vanguard. TRADITIONAL (K). VANGUARD RETIREMENT. PLAN ACCESS™. INDIVIDUAL (K). SEP-IRA. To participate in a SEP IRA, you must be a self-employed or small company owner with at least one employee. Participation in the SEP IRA plan must be permitted. SEP IRAs Brokerage and trading: Vanguard Trading Other: Vanguard Plan set up automatic contributions into your IRA from your checking or savings account. To begin setting up your SEP IRA plan featuring Vanguard investments, complete this form or call to a traditional, Roth, SEP, or SIMPLE IRA, or to a (b), governmental You can't make a tax-free IRA-to-IRA rollover if you've already made. Investments you can make inside an IRA include: Stocks and options; Mutual funds and exchange-traded funds, or ETFs; Bonds and CDs; Fractional shares through. There's no charge to open a Vanguard IRA. The fund or product you choose may have a minimum investment amount. Minimum investments for Vanguard mutual funds can. Before you start, you'll need: A list of all employees enrolled in this benefit; Their personal contributions per pay period; Your company contribution. If you. SEP (Multi-SEP), and SIMPLE IRA Plans business. This move presents an If you are looking for more options, consider a plan with open architecture. A SEP IRA is a retirement plan that can be established by a small business or someone who is self-employed. · Vanguard offers quality SEP IRA administration for. Open an account and begin investing with these 4 simple steps · Choose account type · Transfer money · Explore investments · Place your trade. Hello friends, I've recently became self employed (mid 30's). I've set up a SEP Ira through Vanguard. I would appreciate advice on. SEP (Multi-SEP), and SIMPLE IRA Plans business. This move presents an If you are looking for more options, consider a plan with open architecture. A SEP is easier to set up and has lower operating costs than a conventional retirement plan and allows for a contribution of up to 25 percent of each employee'. A SEP plan allows employers to contribute to traditional IRAs (SEP-IRAs) set up for employees. A business of any size, even self-employed, can establish a SEP. SEP IRAs must be established and funded by your tax filing deadline plus applicable extensions. How to make contributions. You may generally deposit checks by. When you open an account with Schwab, select "investment account transfer" as your funding option. Your account will be approved and ready to fund within. Minimum opening deposit: $0. ○ $0 account open or maintenance fees. Other account fees, fund expenses, and brokerage commissions may apply Find out more. Step 1: Open up an account with Vanguard · Step 2: Contribute $7, to your Traditional IRA First · Step 3: Wait days before making the Roth Conversion · Step.

Citibank Debit Card Limit

Increased Daily Limits on ATM/Debit Card cash withdrawals ($) and increased limits with Debit Card purchases ($10,). Show More. Bank with Ease &. The usual Citibank credit card limit is $ to $2, at a minimum, depending on the card. The Citi Double Cash® Card has a $ minimum credit limit, for. Debit Card for Non-Resident Ordinary Rupee Checking Account ; Maximum Daily Limit. Equivalent of Rs. 75, in local currency. Equivalent of Rs. , in local. Citibank debit card foreign transaction fees ; Citibank Account Package³, 3%, 25 USD monthly fee, waived if account conditions met ; Citi Priority Package⁴, No. No mileage cap. There is no maximum number of American Airlines AAdvantage® miles that you can accumulate through your CitiBusiness® / AAdvantage® credit card. CitiBank Debit Card · One reward point on every transaction of Rs · No charges for cash withdrawals from ATMs of other banks. · Complimentary purchase. Payments & Transfers ; Maximum Daily Limit. Equivalent of Rs. 75, in local currency. Equivalent of Rs. , in local currency. FAQs: Citibank Debit Card (1) What is the transaction limit for a regular account? An individual can use an equivalent of Rs, in local currency on a. Citi customers with the Citigold® Account or the Citi Priority Account can spend up to $10, a day with a Citi debit card. If you have any other kind of Citi. Increased Daily Limits on ATM/Debit Card cash withdrawals ($) and increased limits with Debit Card purchases ($10,). Show More. Bank with Ease &. The usual Citibank credit card limit is $ to $2, at a minimum, depending on the card. The Citi Double Cash® Card has a $ minimum credit limit, for. Debit Card for Non-Resident Ordinary Rupee Checking Account ; Maximum Daily Limit. Equivalent of Rs. 75, in local currency. Equivalent of Rs. , in local. Citibank debit card foreign transaction fees ; Citibank Account Package³, 3%, 25 USD monthly fee, waived if account conditions met ; Citi Priority Package⁴, No. No mileage cap. There is no maximum number of American Airlines AAdvantage® miles that you can accumulate through your CitiBusiness® / AAdvantage® credit card. CitiBank Debit Card · One reward point on every transaction of Rs · No charges for cash withdrawals from ATMs of other banks. · Complimentary purchase. Payments & Transfers ; Maximum Daily Limit. Equivalent of Rs. 75, in local currency. Equivalent of Rs. , in local currency. FAQs: Citibank Debit Card (1) What is the transaction limit for a regular account? An individual can use an equivalent of Rs, in local currency on a. Citi customers with the Citigold® Account or the Citi Priority Account can spend up to $10, a day with a Citi debit card. If you have any other kind of Citi.

Withdrawal at CitiBank ATM · Free first 5 transactions in a month. · For any financial transaction beyond the transaction limit, Rs. 20 is charged; and for any. Is there a limit to the number of concert tickets a Citi credit card or Citibank Debit Card customer can purchase? Ticket limits per show vary by event and. Use your Citi® card to access presale tickets and exclusive experiences to music, sports, arts and cultural events. If you would like to request a Card Agreement, please log into your Citi Why is my available credit less than the difference of my credit limit and balance? Withdrawal Limitations. ATM Withdrawal Limit. $1, per Citibank® Banking Card, per Business Day. PIN and Signature. Based Purchases. • Signature Based. How many times can you use your Citi Bank Debit Card at an ATM machine in a day? Bank) have a limit of $ per transaction. If you. Each business can have a maximum of 1, accounts. Users can only set up 12 express payments at a time. Users are only allowed 14 standing orders per payee. Your Citibank® Debit Card is contactless for added convenience and chip-enabled for extra security—just tap your card and enjoy quick and easy shopping. Your. Have your account number and valid check from a U.S. bank ready when you call. There is no fee when you pay through Citibank's automated system. By text: Text*. The usual Citibank credit card limit is $ to $2, at a minimum, depending on the card. The Citi Double Cash® Card has a $ minimum credit limit, for. There is a daily limit to prevent fraud Assume arguendo, your daily limit is $ You can withdraw as often as you like in a day. However. Foreign ATM: USD ATM Cash Withdrawal Limit, BDT 40, (per transaction). BDT , or USD Equivalent (Per Day). Incoming Fund Transfer**, BDT * Eligible Customers must purchase subscriptions with their Citibank® Debit Card as follows: Daily ATM/Debit Card cash withdrawal limits. Up to $2, The maximum limit for the same is AED , CitiPhone Banking – With this Citibank debit card, you can access the round-the-clock CitiPhone banking services. Increased limits for Zelle® payments, debit card purchases and daily ATM withdrawals. Meaning you can make purchases at merchants per day up to $2K. Your withdrawal limit will be what you can pull from the ATM daily. Double check. You can establish a limit of up to AED , per month, allowing you to shop freely. To activate and set a spending limit on your card, simply call the bank's. Your bank's daily ATM withdrawal limits ; Chase. Up to $3, ; Chime®. $ ; Citi®. $1, to $2, ; Discover® Bank. $ lakhs and Rs lakhs per day. Debit Card for Non-Resident External Rupee Checking Account. The debit card offered under this category can be used at any. CitiBank Debit Card · One reward point on every transaction of Rs · No charges for cash withdrawals from ATMs of other banks. · Complimentary purchase.

How Much In Renters Insurance

Renters insurance is relatively inexpensive. According to NerdWallet, the average renters policy costs about $15 per month for up to $30, in personal. How to save on renters insurance. Although renters insurance is typically less expensive than homeowners insurance, there are ways to save. Here are some of the. According to our most recent data for our best renters insurance companies rating, the monthly cost ranges from just over $13 per month up to $30 per month. This post explores what goes into rental insurance premiums, average prices, and how to find the best cheap renters insurance quotes. How much does renters insurance cost? Renters insurance can cost as little as $10 per month (the national average is around $15 per month or $ a year. The average cost of renters insurance is $12 per month. Learn what factors dictate pricing and how you can lower your premium. According to the latest data available from the Insurance Information Institute (Triple-I), the average cost of renters insurance is $ $ per year, or about. Renters insurance runs about $15 a month for approximately $35, in coverage limits, based on the National Association of Insurance Commissioners (NAIC). Renters insurance costs $14 to $25 per month on average, depending on the insurance company, where you live and how much coverage you buy. Renters insurance is relatively inexpensive. According to NerdWallet, the average renters policy costs about $15 per month for up to $30, in personal. How to save on renters insurance. Although renters insurance is typically less expensive than homeowners insurance, there are ways to save. Here are some of the. According to our most recent data for our best renters insurance companies rating, the monthly cost ranges from just over $13 per month up to $30 per month. This post explores what goes into rental insurance premiums, average prices, and how to find the best cheap renters insurance quotes. How much does renters insurance cost? Renters insurance can cost as little as $10 per month (the national average is around $15 per month or $ a year. The average cost of renters insurance is $12 per month. Learn what factors dictate pricing and how you can lower your premium. According to the latest data available from the Insurance Information Institute (Triple-I), the average cost of renters insurance is $ $ per year, or about. Renters insurance runs about $15 a month for approximately $35, in coverage limits, based on the National Association of Insurance Commissioners (NAIC). Renters insurance costs $14 to $25 per month on average, depending on the insurance company, where you live and how much coverage you buy.

Liability: Your renters personal liability insurance coverage can help cover the associated legal costs and related damages. Most renters insurance policies. Liability: Your renters personal liability insurance coverage can help cover the associated legal costs and related damages. Most renters insurance policies. How much does renters insurance cost? Renters insurance can cost as little as $10 per month (the national average is around $15 per month or $ a year. This post explores what goes into rental insurance premiums, average prices, and how to find the best cheap renters insurance quotes. The average premium for a renters policy is $16¹ per month, and as low as $4² per month when you bundle with an auto policy. Take a look at the coverage options. Renters insurance covers and protects your belongings. Customized rental coverage, low rates, and 24/7 claims service. Get a free quote in minutes! Additional liability coverage – Typically, the base liability amount on your renters policy is $, To maximize your peace of mind, you may want to. How much you pay for renters insurance depends on how much coverage you choose to buy and what deductibles you select. The good news is a renters insurance. How much is renters insurance? The costs vary by state, type of coverage and individual items under protection. Uncover the average cost of renters. Renters insurance that keeps your stuff safe. Renter tested. Landlord approved. Starting from $5/mo. Check our prices. scroll arrow. For as little as $5 a month, renters insurance is a surprisingly cheap way to keep the things you love safe and protected. Get a free online quote. The average cost of Lemonade renters insurance across the US is around $14/month with prices starting as low as $5/month, as of March How Much Is the Average Renters Insurance? The average cost of renters insurance in was $ per year in the United States. Renters insurance costs are. According to National Association of Insurance Commissioners' data the average policy costs only $ per year. That works out to slightly more than $15 per. How much does renters insurance cost? You can expect to pay as little as $10 a month for a renters policy. What you pay depends on how much you cover and. If you did have to make a claim, how much did the insurance company try to blame and deflect and ignore before finally paying out? The average cost for renters insurance is just over $10 a month, that number can vary depending on the amount of coverage you have and any additional coverages. A $K renter's insurance policy will cover most, if not all, of your belongings. There are some exceptions, which we will get to in a moment. The policy. The cost of a renters insurance policy depends on the collective value of the property you're insuring, where you live, your credit score, and the type of. When considering renters insurance, the first thing to think about is how much personal property coverage and how much liability coverage you need.